EK ADVISORY SERVICES

EK ADVISORY SERVICES

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

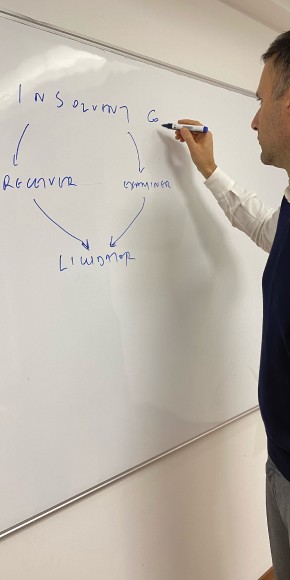

- Insolvency

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

- Insolvency

Compliance

We work in line with the latest international standards on preventing money laundering, terrorist financing and tax evasion. We aim to ensure that all our clients are fully compliant with local and international regulations.

We are ready to provide tailor-made, in-depth reports for individuals/organizations depending on the needs of your business. Our services include the following:

Risk and Regulatory compliance

Assist in obtaining a license from the Cyprus Security Exchange Commission (CySEC) as a Cypriot Investment Firm

Monitoring firms regulated by CySEC to comply with the relevant legislation

Ensure that financial institutions comply with the relevant regulations set by the Central Bank of Cyprus (CBC)

Compliance - Due Diligence

We provide tailor-made, in-depth reports for either individuals or organizations based on our clients’ specific needs.

Our in-depth, reliable reports in AML and KYC compliance helps you to minimize your business risk, exposure, and reputation damage.

Know Your Customer Reports

“Know Your Customer” (KYC) is a regulatory and legal requirement as well as a process through which customer identification is achieved, based on reliable and independent documents or information. Simple KYC reports can be created on an ad hoc basis to verify the identity of the clients so as to assist in managing the Company’s risk prudently.

Why is KYC required:

- Identification and verification the identity of the clients

- Compliance with global KYC legislation

- Management the risk of the entity

Our data sources include:

- Global Sanctions Lists

- Global Enforcement Lists

- Global Adverse Media

- Global Politically Exposed Persons (PEP) List