EK ADVISORY SERVICES

EK ADVISORY SERVICES

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

- Insolvency

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

- Insolvency

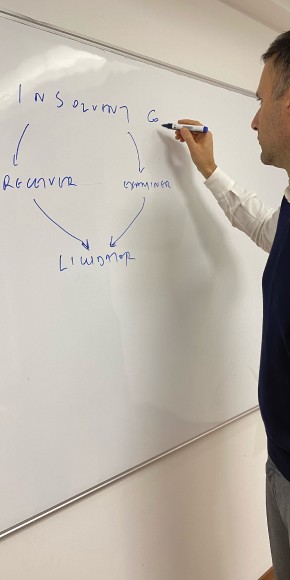

INSOLVENCY

If you are facing a time of personal or corporate financial crisis you need advice from someone who listens, who understands your specific issues and deals with them in a supportive and sensitive manner.

We provide services to lenders and other stakeholders of troubled or under-performing businesses. Over the years, our insolvency practitioners have held a significant number of appointments in a range of insolvency situations, accumulating unsurpassable experience. We have designed and implemented customised solutions to a variety of business-recovery and insolvency situations in a wide range of industries and fields.

If you are facing financial distress or insolvency, we can help if action is taken early enough. We deploy a team of specialists to work with you developing tailor-made solutions.

Our team of experts assist with the performance of independent viability assessments of troubled businesses and analyses of the recovery options available to the business and its lenders with clear and transparent recommendations. We also undertake to monitor, on behalf of lenders, a borrower's financial performance and/or a borrower's compliance with conditions set by the lender for continuing support.

At EmilianidesKatsaros we pride ourselves on giving realistic advice, as well as having the ability to recognise the sensitivities of any particular situation.

With licensed insolvency practitioners as members of our team, we are able to take appointments and deal with:

- Administrations

- Administrative receiverships

- Bankruptcy

- Compulsory liquidations

- Creditors voluntary liquidations

- Fixed charge receiverships

- Members voluntary liquidations

Personal Insolvency

Whether you are an organisation or an individual, debt continues to be a key challenge.

We are a leading provider of personal insolvency services, delivering practical solutions in a sensitive manner, maximising recoveries for creditors or helping individuals seeking appropriate debt-relief solutions.

Our team of dedicated specialists provides solutions and advice both to creditors and debtors.