EK ADVISORY SERVICES

EK ADVISORY SERVICES

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

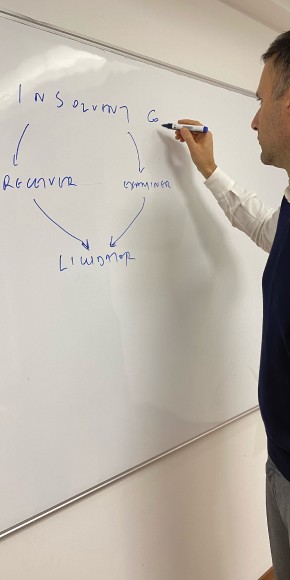

- Insolvency

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

- Insolvency

LICENSING & SUPERVISION

- Investment Firms

Currently there are more than 200 investment firms regulated by the Cyprus Securities and Exchange Commission (“CySEC”). For all organisations engaged in activities that come under the supervision of the CySEC, a proactive rather than a reactive approach to regulation saves time and effort at a later stage. In an ever-changing regulatory environment, investment firms in Cyprus are faced with the challenge of adapting to new regulations which set down demanding requirements, whilst also managing compliance costs. EmilianidesKatsaros has a dedicated team of advisory consultants specialising in the various regulations governing the sector, assisting many clients, through a broad range of services, to comply with their regulatory obligations.

We help Cyprus Investment Firms to confidently navigate regulatory changes, addressing their needs for integrated and practical solutions that cover the entire regulatory agenda and beyond. These changes must, and do, deliver real and significant benefits to their businesses.

Our dedicated advisory consultants recognise that every business is different. We can help you assess the impact of regulations on your business, as well as develop and implement a strategic response that empowers you to take control of the regulatory agenda.

If you aim to operate a regulated Investment Firm in Cyprus, you need to apply to CySEC and obtain the relevant license. In a continuously changing regulatory environment, you need to identify whether a license is needed and set up your operations in the best possible way, thus saving time and money in the process of obtaining it.

Among others, our advisory consultants may assist you with the following:

- Preparation or review of the full application package that needs to be submitted to CySEC.

- For already licensed investment firms, preparation, or review of the application to the regulator to set up a branch abroad or offer cross-border services.

- In the case of licensed investment firms, preparation, or review of the application to CySEC in order to obtain a license for the provision of additional investment services.

- Implementation of the conditions that may be attached to an operation license as a regulated Investment Firm in Cyprus.

- Payment Institution

Payment services in the Republic of Cyprus may only be provided by a payment institution which has been granted authorisation by the Central Bank of Cyprus (CBC). Authorisation for the operation of a payment institution is only granted to legal persons which have been incorporated and have their head office in the Republic.

The following persons may provide payment services in the Republic of Cyprus without obtaining the prior approval of the CBC:

- Banks licensed by the CBC or by a competent supervisory authority of another EU member-state.

- Cooperative societies which have been licensed by the Authority for the Supervision and Development of Cooperative Societies or by the competent supervisory authorities of other EU member-states.

- Electronic money institutions which have been licensed by the CBC or by competent supervisory authorities of other EU member-states.

- Post office giro institutions which are entitled under national legislation to provide payment services.

- The European Central Bank and national central banks, when not acting in their capacity as monetary or other public authorities.

- Member-states or regional or local authorities, when not acting in their capacity as public authorities.

- Payment institutions that have been granted and maintain a valid authorisation to operate by the competent supervisory authorities of other EU member-states.

These institutions may either exercise the right of establishment or the right to provide services on a cross-border basis, provided that the competent authorities of the home member-state submit a notification to the CBC.

Our advisory consultants are ready to assist your organisation with the process and legal drafting of the supporting documentation required for it to be a legal person interested in obtaining authorisation from the Central Bank of Cyprus to provide payment services.

Our services with regards to the licensing of a Payment Institution include a wide spectrum of services required, including:

- Preparing the Application

- Drafting the required questionnaires

- Compiling the appropriate and relevant information

- Advising on Management structure

- Legal drafting and counselling

- Communicating with the CBC on behalf of the client

- Ensuring tax compliance