EK ADVISORY SERVICES

EK ADVISORY SERVICES

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

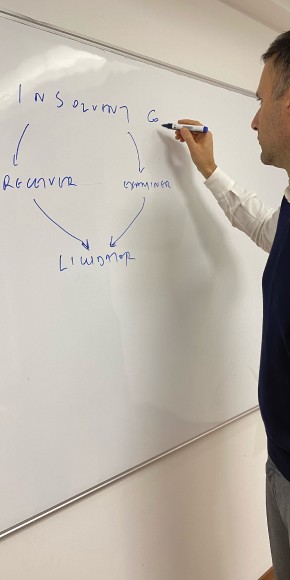

- Insolvency

- AIFS/AIFMS/CIFS

- Asset Management & Protection

- Blockchain

- Compliance

- Data Protection

- Debt Recovery & Restructuring

- Insolvency

Foreclosures

Following the amendment of the Transfer and Mortgage Law No. 9/1965 with Law 142(I)/2014, the term of private auctions was introduced and thus the credit institutions now have a powerful tool in recovering debts. Our firm actively participated in the committee for the amendment of the Transfer and Mortgage Law 9/1965, which introduced the term of private auctions.

Due to the high volume of non-performing loans, the financial institutions welcomed the above stated amendment, and the number of auctions has increased significantly in the past years. However, credit institutions often face application/appeals which aim to block the foreclosure procedure and/or face complicated legal matters in applying the Law. Therefore, credit institutions need extensive legal support and they have turned to the solution of outsourcing foreclosure projects.

Our firm was the first law firm to undertake the outsourcing of a foreclosure project, in 2016, with success and currently our firm advises some of the largest credit institutions and credit acquiring companies in Cyprus.

Our experienced foreclosure team is currently providing in-house daily assistance regarding the foreclosure procedure to the biggest financial institution of Cyprus.

Our advisory team is constituted by experienced lawyers in the practical enforcement of Law No. 142(I)/2014 from the beginning until the end of the foreclosure procedure.

Our services include the complete spectrum of the foreclosure procedure ranging from advising local banking institutions on how to apply the Law, to holding relevant seminars and to handling the entire foreclosure procedure.

At the moment, we are in the process of acquiring the ISAE 3000 certificate from an independent auditor for the data protection of the personal information of the Bank’s clients that we keep in our offices.

In particular, we offer a broad array of foreclosure support services, which include:

- Review of facility documentation

- Production of all relevant notices

- Booking auctions

- Managing the required publications

- Litigation Services

- Repossession of Assets

- Advising on legal matters that arise throughout the foreclosure process

- Negotiations

- Advising the Association of Cyprus Banks regarding the E-Auctions

- Advising local financial institutions regarding the ESTIA scheme

- Holding seminars regarding the foreclosure legislation